The Civil Code of Quebec contains provisions governing the distribution of the property of a person who dies without a will, first favoring the deceased's closest relatives and then progressively including more distant relatives. All these provisions are known as legal devolution.

The first question to ask when settling the estate of a person who died without a will is whether he or she had a spouse with whom he or she was married or in a civil union, and children.

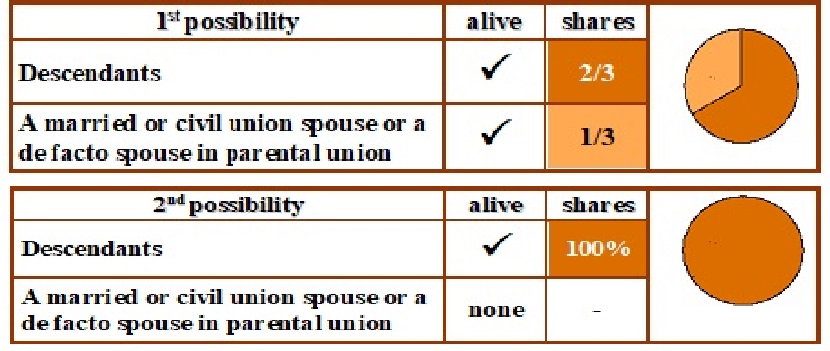

In this case, the surviving spouse, married or in a civil union, or the de facto spouse in a parental union with the deceased, will receive 1/3 of the deceased's patrimony. The deceased's children will receive 2/3 of the deceased's patrimony. This fraction of the deceased's patrimony must be divided according to the number of children of the deceased. Grandchildren may have rights in the estate of deceased grandparents if their own parent (i.e. a child on the 1st degree child of the deceased) died before them.

If the deceased leaves only children, the latter will receive, between them, the deceased's entire estate.

These tables enable you to determine the heirs in the event of death without a will