The Civil Code of Quebec contains provisions governing the distribution of the property of a person who dies without a will, first favoring the deceased's closest relatives and then progressively including more distant relatives. These provisions are known as legal devolution.

When the deceased leaves a surviving spouse, but no descendants, the Civil Code of Quebec includes the privileged ascendants (father and mother of the deceased) and the privileged collaterals (brothers, sisters, nephews and nieces of the deceased) in the settlement of the deceased's succession.

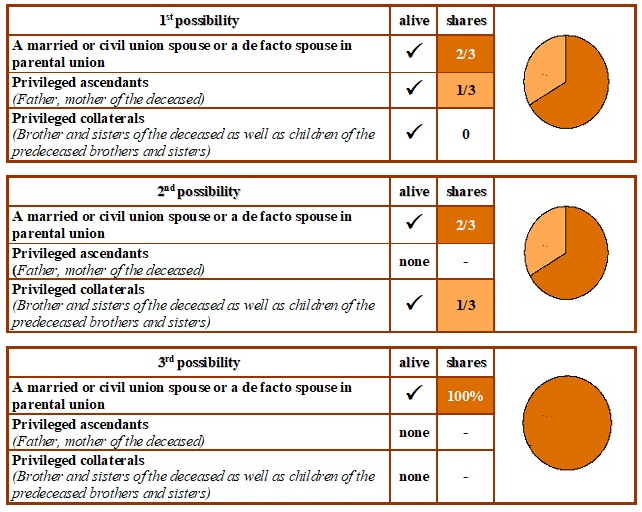

The first hypothesis is therefore that of a spouse, married or in a civil union or de facto spouse in a parental union, and ascendants who survive the deceased. In this case, the spouse will receive 2/3 of the deceased's patrimony and the ascendants 1/3 of this patrimony. If one or both of the deceased's ascendants survive, the preferred collaterals receive nothing.

The second hypothesis is the presence of a spouse, married or in a civil union, or a de facto spouse in a parental union, when the deceased's privileged ascendants are already deceased. In this case, the surviving spouse must share his or her deceased spouse's patrimony with the latter's privileged collaterals. In this case, the surviving spouse will receive 2/3 of the deceased's patrimony, and the surviving spouse's collaterals 1/3 of the deceased's patrimony. The rights of the children of deceased siblings, nephews and nieces, only arise on the death of their parents.

In this case, the surviving spouse, if married or in a civil union, will receive the deceased's entire estate.

These tables enable you to determine the heirs in the event of death without a will