The duties on transfer of immovables (also called property transfer tax) is a tax imposed by municipalities on real property transactions in their territory under the Act respecting duties on transfers of immovables.

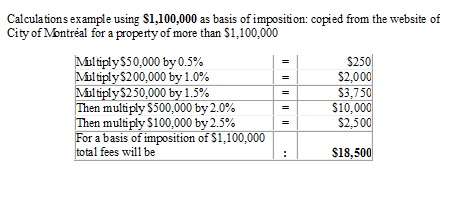

The duties on transfer of immovables increase with the size of the transaction and are based on the highest amount between the sale price and the property commercially reasonable price at the time of the transfer (amount of imposition); they usually are of 0.5% of the amount of imposition for the first $50,000, plus 1% from $50,000 up to $250,000, plus 1.5% from $250,000 up to $500,000, plus 2% for the amount exceeding $500,000 (plus 2.5% of the amount exceeding $1,000,000 for a property located in montreal).

Sales transactions less than $5,000 are exempt from transfer duties. The Act respecting duties on transfers of immovables includes a number of exemptions, for example a transaction between spouses, a transaction between parent and child, a transaction between two companies, one of which is owned at 90% by the other, etc.